Stock marketing investing has always had this kind of glamour about it, and its heroes (and villains) have attained rockstar status. From Warren Buffet to the Barefoot Investor to The Wolf of Wall Street, most people who haven’t investing in stocks will have heard of these investors or will have seen that film.

But what about names like Donald Bren or Stephen Ross? If you’ve never heard of these real estate investors, we’re not surprised. These guys may not be rockstars, but they are billionaires who made their fortune through real estate investment. While real estate investing certainly isn’t as ‘exciting’ or ‘glamorous’ as stock picking, it possesses some huge benefits over stock market investing.

Here, the investment property specialists at Patrick Leo discuss the benefits of investing in real estate vs stocks.

Truly passive income

Real estate investing gives you a passive income and passive capital gains, meaning it makes you money without having to do anything. While stocks can go up overnight and increase your wealth, you still need to be paying attention to the market and know when to buy and sell in order to make a profit. With real estate, however, you can be guaranteed that the rent will roll in every week or fortnight.

Easier, more effective management

We know what you’re thinking: you still have to manage your real estate portfolio and all the tenancy and maintenance responsibilities that come with it. This is true, but that’s why most landlords choose a high-quality property management service to handle this for them. Property management is affordable and reliable, unlike the stock market’s equivalent: active hedge fund managers.

Warren Buffet, one of history’s most successful stock market investors once bet $1 million that he could beat a handful of fancy, expensive hedge funds simply by investing in an S&P 500 index fund. He beat every fancy handpicked fund, proving that active hedge fund management often isn’t worth it.

Lower risk, less fluctuation

Real estate investment is a far lower risk than stock investing, and has experienced far less fluctuation. While the stock market is prone to crashing every 10 or so years, real estate in Australia has experience less crashes of much smaller scale. While no investment is totally risk-free, real estate investment is as low-risk as you can get.

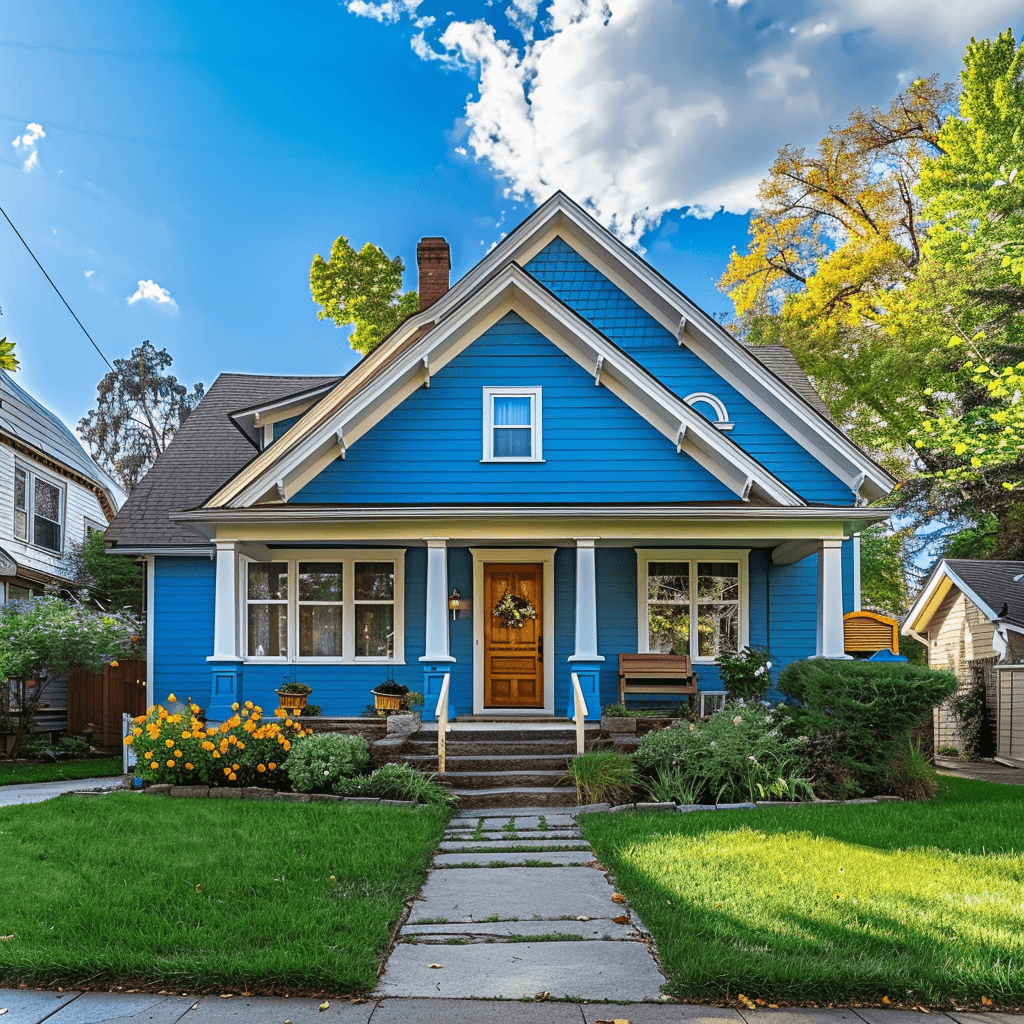

Tangible asset

And above all, real estate is an asset you can see in the flesh, and something that will always have value to you, whether it provides you with a place to live or a place to rent out to others.

There are some clear benefits of real estate investing over stock market investing, and nobody knows this better than the team at Patrick Leo. At Patrick Leo, we’ve spent over 20 years increasing the wealth and happiness of our clients by finding them high quality investment properties and helping them build a portfolio. If you’re interested in starting your real estate portfolio, get in touch with the experts at Patrick Leo today.