Despite facing relatively slow performance compared to other capital cities over the past year, Melbourne’s housing market is on the verge of an upswing in 2024.

As it stands, Melbourne’s housing market is undervalued.

With record-low vacancy rates driving rental prices sky-high in a fiercely competitive market, this presents ideal conditions for savvy investors to capitalise on. Waiting could mean competing with owner-occupiers for prime properties once interest rates decline.

However, not all Melbourne properties are equal—knowing where and what to buy, and identifying investment-ready suburbs, is crucial – and we’re here to help. With our extensive market intel and access to stock Victoria wide, we can assist you in capitalising on the market and reaching your financial goals.

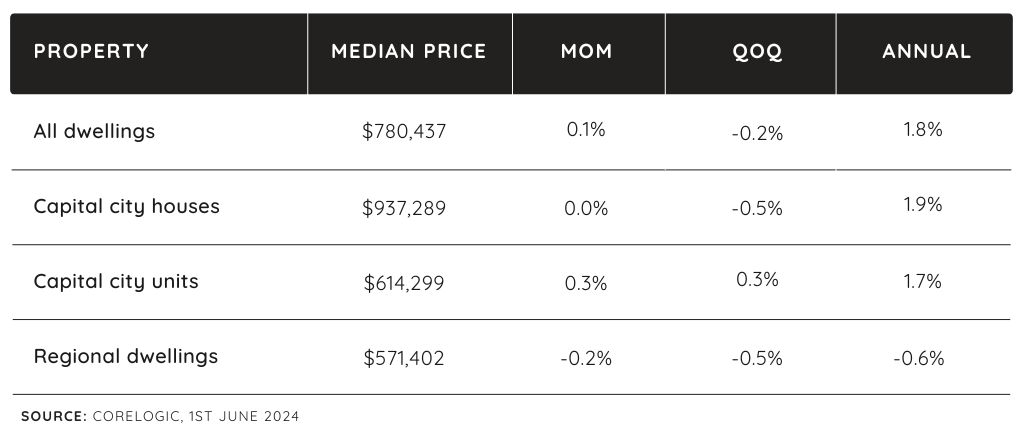

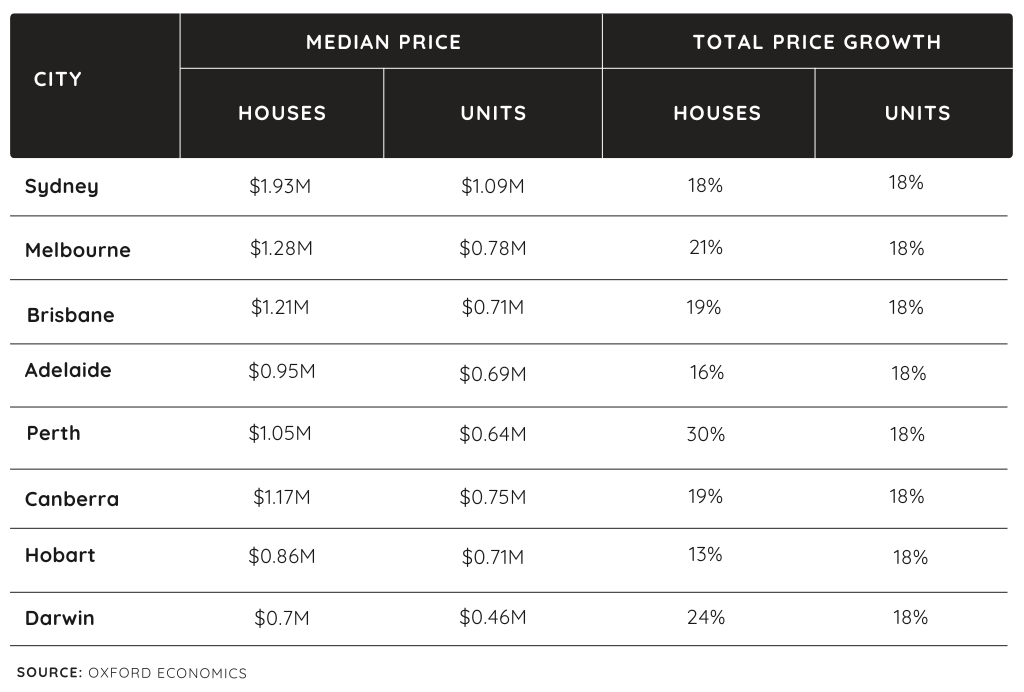

Melbourne’s median property prices:

Melbourne’s current market conditions offer a unique advantage for investors. As it stands Melbourne property prices have increased by 11% since 2019. Although median property prices have lagged, this has created a window for strategic investment.

Notably, the average price of a standalone house in Melbourne is the lowest it has been relative to its Sydney counterpart in 20 years.

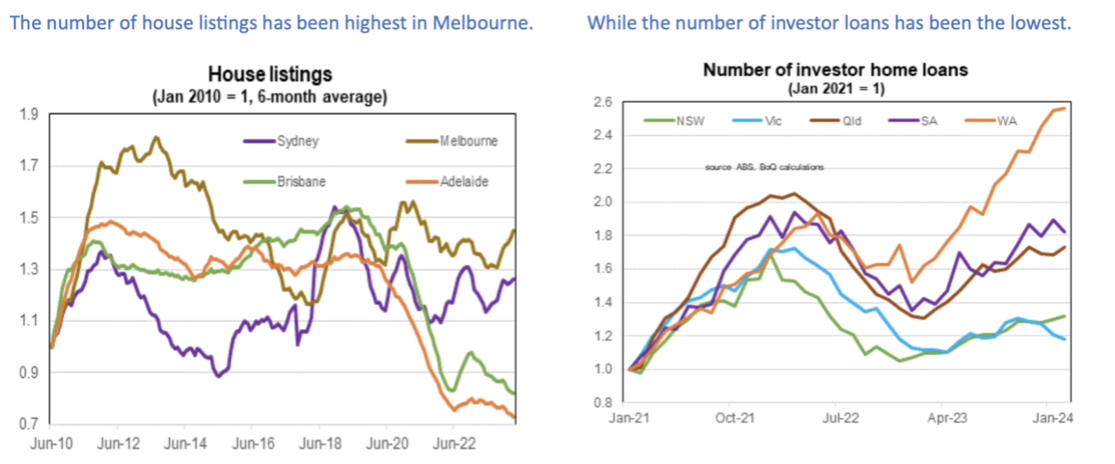

Why has Melbourne been underperforming?

The Melbourne market may be affected by a larger inventory of homes available for sale compared to other states. Additionally, investor interest in Melbourne has declined due to dissatisfaction with the Victorian government's policies, which appear to favour tenants over investors.

Finally, COVID-19 had a profound impact on Melbourne's market, enduring the world's longest lockdown. This backdrop influenced household sizes, as many faced rising rents and living costs, prompting moves to shared or family homes, thus affecting demand.

Despite this, more than 50 Victorian suburbs saw growth in value that exceeded average house price growth in 2023.

The Melbourne market still shows strong demand for A-grade homes and investment-grade properties, whilst B-grade properties are slower to sell, and C-grade properties are generally avoided. This opens opportunities for investors who consider the long-term.

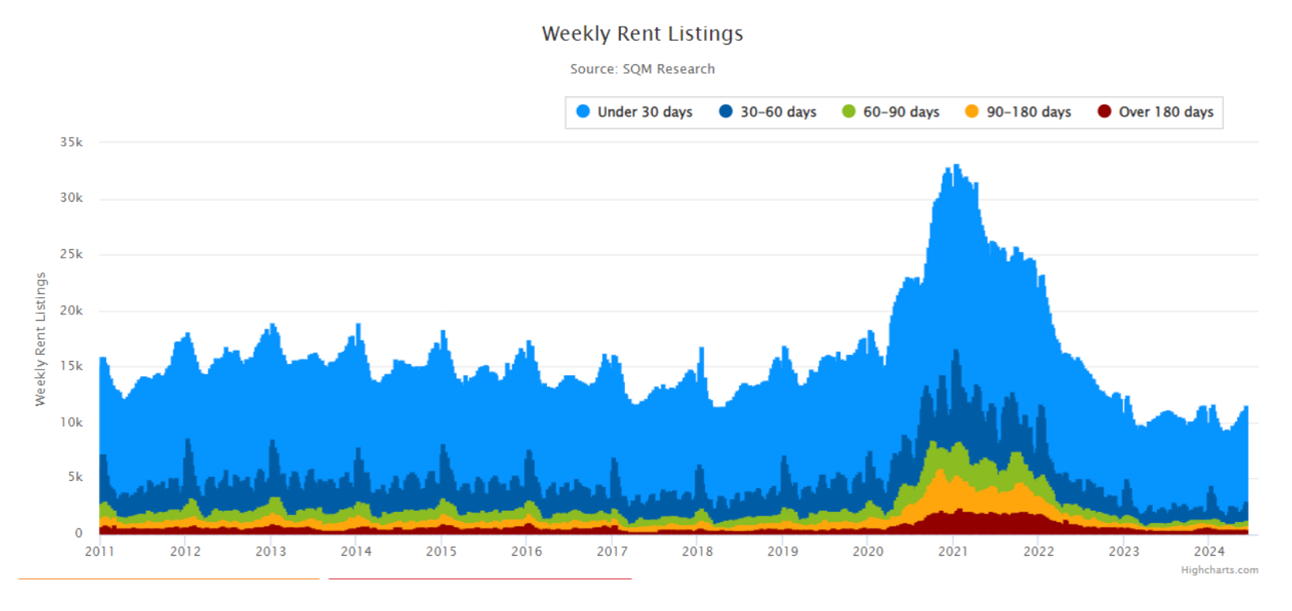

A tight rental market:

SQM Research posits Melbourne’s vacancy rate at 1.5% further fuelling demand and competition amongst renters.

Melbourne's competitive rental market is fuelled by a strong economy driven by finance, technology, and healthcare, coupled with ongoing population growth attracting more residents.

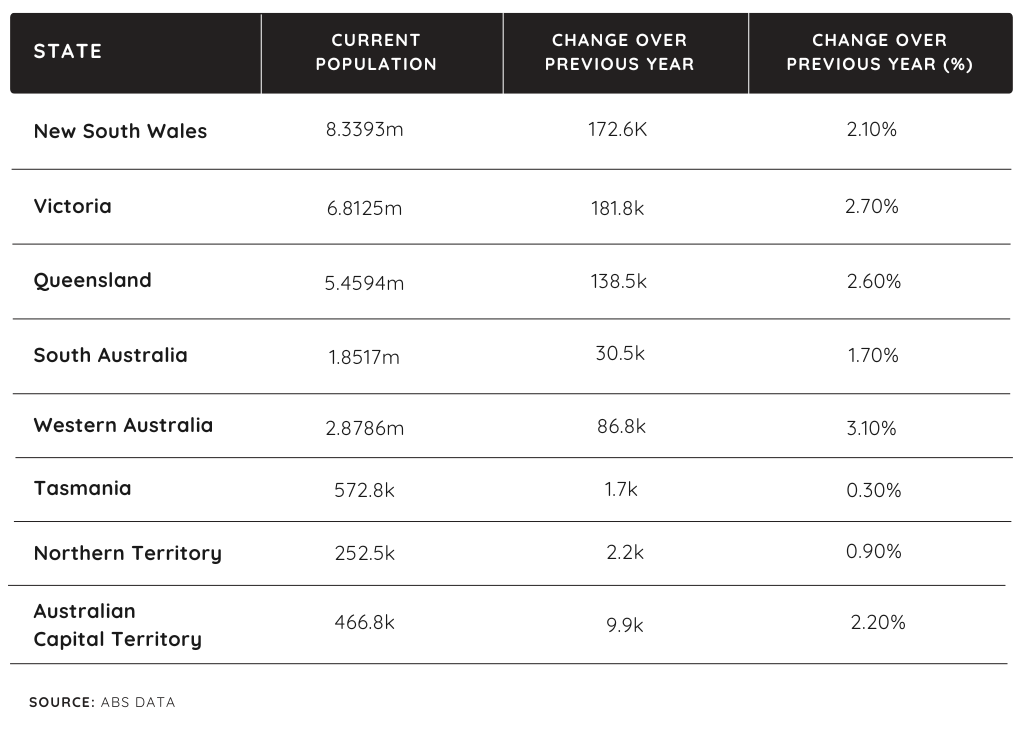

Population growth increasing demand:

Melbourne's population dynamics are further bolstering the market’s potential.

With the city housing 5.8 million residents and Victoria's population at 6.8 million, sustained population growth—largely driven by migration—sets the stage for increased housing demand. Projections suggest that Melbourne's population could reach 8 million by 2050, requiring approximately 1.5 million new dwellings to meet demand, further supporting property price increases.

Growth is on the horizon:

Expert forecasts vary, but generally predict a positive outlook for Melbourne's property market in 2024:

- ANZ forecasts a 3-4% property price rise.

- CBA forecasts a 5% property price rise.

- NAB forecasts a 5.5% property price rise.

- Westpac forecasts a 3% property price rise.

- PropTrack forecasts a 1-4% property price rise.

- SQM forecasts up to a -3% property price fall.

Oxford Economics has projected significant growth in property prices for both houses and units in Melbourne over the next three years, foreseeing a return to the city's long-term average growth rates.

The combination of undervalued property prices, robust population growth, and soaring rental yields creates an ideal environment for investment. Securing the right property now could lead to substantial equity growth in Melbourne’s promising market.

Contact us today to capitalise on these favourable conditions and secure your financial freedom.